Elite Asset Management’s new A.I. algorithmic analysis links financial planning and crypto-friendly approaches.

London, UK — Elite Asset Management, a privately-owned independent financial advisory group, has launched a new A.I. algorithmic analysis to improve traders’ market opportunities. Specialized in investments in the digital assets ecosystem, Elite Asset Management’s team-based approach using an “A.I.” edge delivers a unique blend of specialist skills linking financial planning and crypto-friendly approaches.

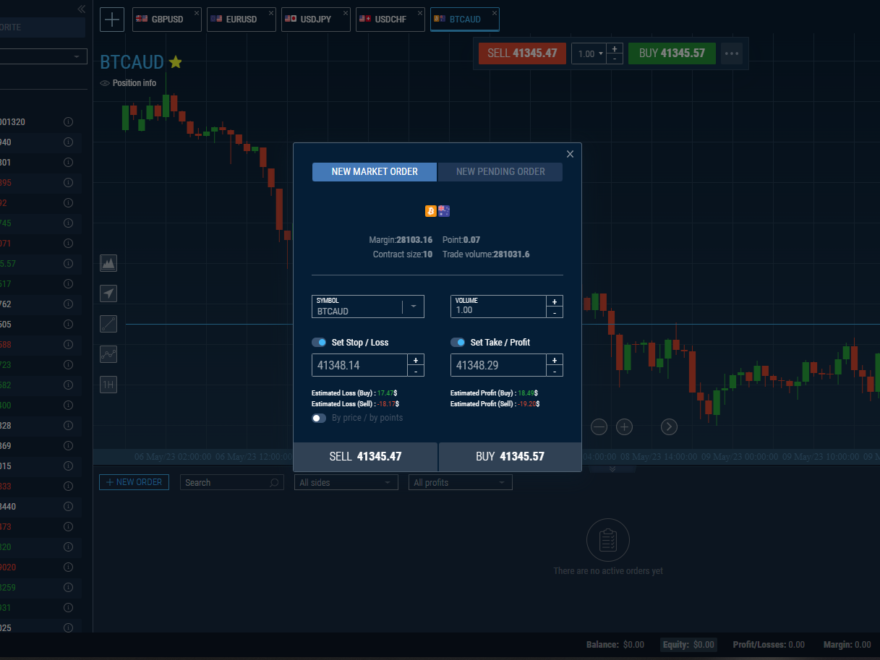

The new A.I. algorithmic analysis is designed to help traders follow price movements and sell or buy automatically when the price goes in another direction or trade automatically with Elite Asset Management’s unique trading A.I. The system leverages tools like DCA, market-making, arbitrage, or Elite Asset Management‘s own free of charge charting software.

New investors from gold account level and above enjoy a Senior Platform Manager, one-on-one support and daily analysis insights. According to Andrew Noble, Managing Director at Elite Asset Management, “Our A.I. algorithms are a terrific system for identifying trading opportunities on asset charts. What distinguishes these signals from others is their significant advantage of utilizing the four phases of the market cycle, namely accumulation, markup, distribution, and markdown.”

Powerful AI-powered crypto trading designed to improve trading outcomes

Elite Asset Management’s powerful AI-powered crypto trading features, designed to help clients save time, trade 24/7, automate their trading, minimize risk, and maximize profits to help clients evolve into better traders.

Automated features, including Trailing Stop Loss (TSL) and Trailing Take-Profit (TTP), are compatible with a wide range of technical indicators, chart patterns, and candlestick patterns. The A.I. trailing tools, such as TSL, Trailing Stop Buy, and Trailing Stop Short, enable clients to set stop losses and buy orders based on specific market movements.

For instance, Trailing Stop Buy tracks the price down and places a buy order as soon as an uptrend begins, while Trailing Stop Short tracks the price down and closes the short as soon as the price starts to rise. TTP allows traders to set their TSL to trigger only after reaching a certain profit, minimizing risk, and maximizing profits.

100+ technical indicators with ML-based fundamental analysis

Leveraging Elite Asset Management‘s global reach and expertise, the company delivers market intelligence and wealth management know-how that matters to clients. EAM experts span all asset classes and investment strategy styles. Their proprietary algorithm combines the knowledge of more than 100 technical indicators with machine-learning-based fundamental analysis.

“Our clients stay with us because of our technical know-how and relationship experience to assist them with immediate access to the crypto market,” says Andrew Noble. “We focus our solutions on real-value creation. Our views are macro-focused, fundamental in nature, and complemented by bottom-up convictions.”

Customized strategies using favorite indicators

Many brokers claim they have automated trading bots but most are completely useless. Elite Asset Management’s AI features are integrated inside the trading platform, and are safe to use as well as legit.

Elite Asset Management’s new A.I. algorithmic analysis provides traders with a unique opportunity to improve their trading strategy and take advantage of market fluctuations. Whether you are a private individual, a company, a trust, or a charity, Elite Asset Management has the expertise and technology to assist in achieving the financial goals in order to maximize profit and minimize risk for the traders.

For more information, please visit Elite Asset Management’s website at

https://eliteassetmanagement.com

Contact: Alex Ferguson – CMO at Elite Asset Management

support@eliteassetmanagement.com

alexf@eliteassetmanagement.com